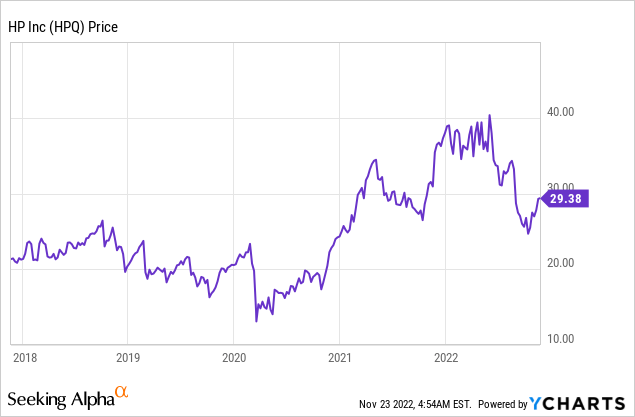

HP Inc.: Short-Term PC Headwinds, Long-Term Opportunity (HPQ)

BalkansCat

HP Inc.NYSE:HPQ() is a technology company with a long history that sells Personal Computers and Printers. The company is experiencing headwinds because of the decline in personal computing. Long term, however, the company is expected to reap the benefits of Growth trends include remote working (after Poly acquired it, discussed later), and 3D printing. The market for 3D printing worldwide was worth $13.8 million in 2021. Prognosticated To grow at a rapid 20.8% compounded annually growth rate up 2030. Let’s get into the financial results and reveal HP’s valuation in this post.

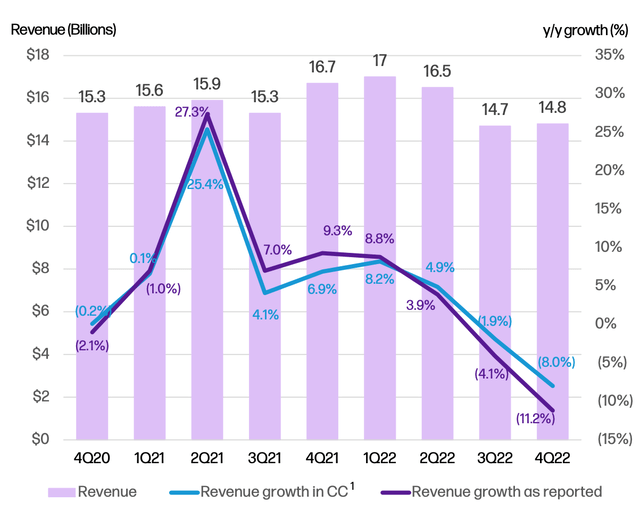

Fourth Quarter Financial Results

For the fourth quarter fiscal year 2022, HP posted solid financial results. Analyst expectations were $124 million higher than the revenue of $14.8 billion. Revenue declined by 11% over the year, or 8%, on a constant currency basis. Management expected this to be due to macro headwinds.

Revenue HPQ (Q4 Earnings report)

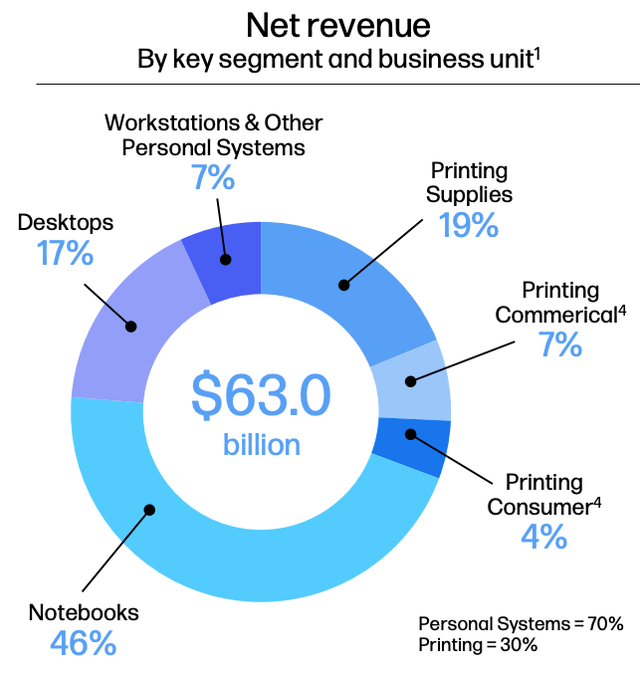

HP derives 70% of its revenue from Personal Systems Revenue, and 30% from Printing revenue. Personal Systems revenue declined by 9% over the year, but increased sequentially by 4% on a constant currency base to $10.3 billion in Q4. The Personal Systems segment can be further broken down into Notebooks (46% of revenue), Desktops (17%), and Workstation & Other systems (7%).

The market is currently experiencing a cyclical downturn, which has led to a drop in demand for consumer computers. A few factors have contributed to this drop in demand. The lockdown of 2020 saw a significant increase in computer and gaming sales. This was because so many people were at home, and it was popular to set up home offices for remote work. Stimulus check programs all over the world made many people “cash-rich”.

But the environment will be completely different in 2022. Both businesses and consumers are being squeezed by high inflation and a rising rate of interest, which results in higher input costs. Despite the economic environment, HP continued to innovate. They announced a new series lightweight notebooks and gaming computers at the CES Event in 2022.

Poly, a provider of video conference solutions, has been acquired by the company for $3.3 billion. Poly provides headsets, microphones and software. Poly-derived financials were included in the fourth quarter results, which include two months of Poly’s financials. Management has said that Poly is performing better than expected. This is a natural result of the growth in hybrid work and the efficient solutions required to make it happen. A study has shown that 63% high-revenue companies use hybrid workforce models.

Positive trends with HP’s Personal Systems unit are a positive move towards more commercial businesses, which accounts for over 75% of this segment’s revenue. This is a great trend to see. Commercial businesses tend have higher order volumes and are more consistent with repeat business.

Segment by Segment: Net Revenue (Q4 2022)

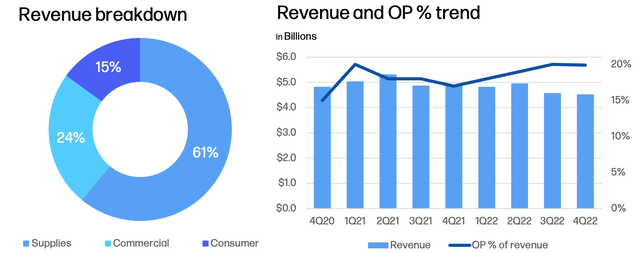

The Print segment saw revenue of $4.5 billion. This was a decrease by 7% or 6% year-over-year. The Consumer market’s softness was responsible for this decline. With the advent of digital technology, Esign (electronic sign) services and the rise in digital technology, physical printers are no longer necessary.

Based on my own experience, an HP printer I purchased five years ago is the one I actually use for postage labels. The user experience is poor. I prefer QR code-based postage labels. The good news for HP: the commercial business has experienced a strong recovery from the pandemic. Revenues from hardware recovery have increased by double digits each year.

HP+ and Big Tank printers are responsible for 55% HP’s printing sales. The quarter saw strong 3D printing, and Industrial graphics sales, which are all increasing year-over-year.

Print Segment Revenue (Q4, F22 Earnings Review)

Profitability and Expenses

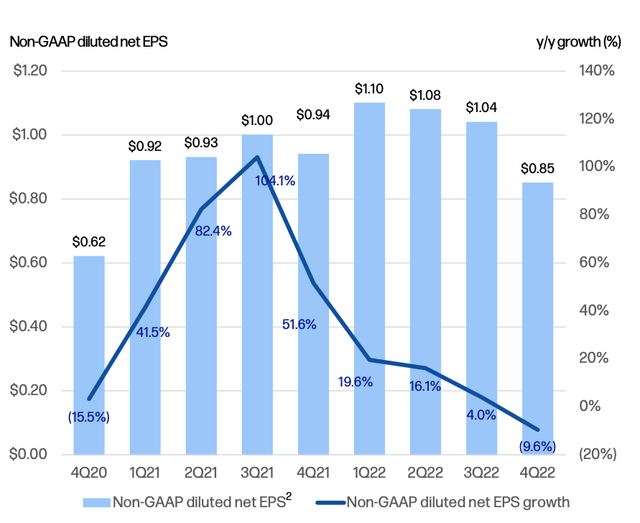

Non-GAAP operating income of $1.1 Billion was generated by HP, which fell 15% year-overyear. Non-GAAP earnings for shares was $0.85, a decline from the $0.94 in previous years. This was still above analyst expectations of $0.01. Remember that the non GAAP results do not include net expenses of $855million which are primarily related to restructuring costs, acquisition costs, and tax adjustments. Non-GAAPEPS increased by 8% for the entire year 2022 to $4.08.

Earnings per Share (Q4,F22)

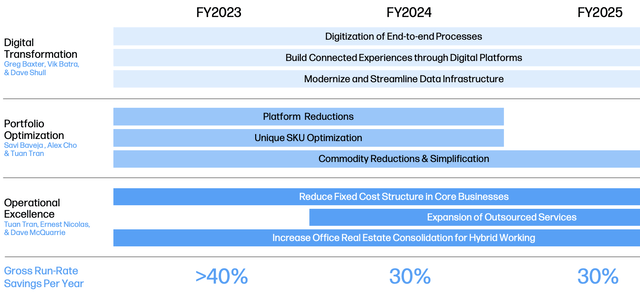

The HP Management has created a variety of cost-cutting measures to streamline the business. These include Digitization of all company processes, inventory optimization and a lower fixed cost structure. These activities, and others, are expected to result in $1.4 billion annually in annualized run rate savings by fiscal year 2023. This plan was a huge success. The company saw an increase in OpEx spending of $350million year-over-year.

Cost Saving Plan (Q4,FY22 report)

The company generated $3.9 billion in free cash flow over the year, and paid $5.3 billion back to shareholders through stock buybacks or dividends. The company pays a healthy 3.4% dividend that has increased over the past 11 year.

The company has a strong balance sheet with cash and cash equivalents totaling $3.145billion and short-term investments totalling $17m. HP has a high level of long-term debt at $10.8 billion. However, only $218 million is current debt.

Advanced Valuation

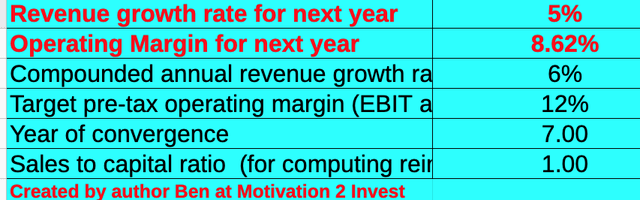

To value HP I have used the most current financials to build my advanced valuation model that uses the discounted-cash flow (“DCF”) method. As the personal computing segment recovers, I forecast a conservative 5% growth in revenue for next year.

Valuation of HP stock (Ben at Motivation 2 invest created this guideline.

To increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted the operating margin. The company’s cost-cutting efforts will result in an operating margin of at least 12%.

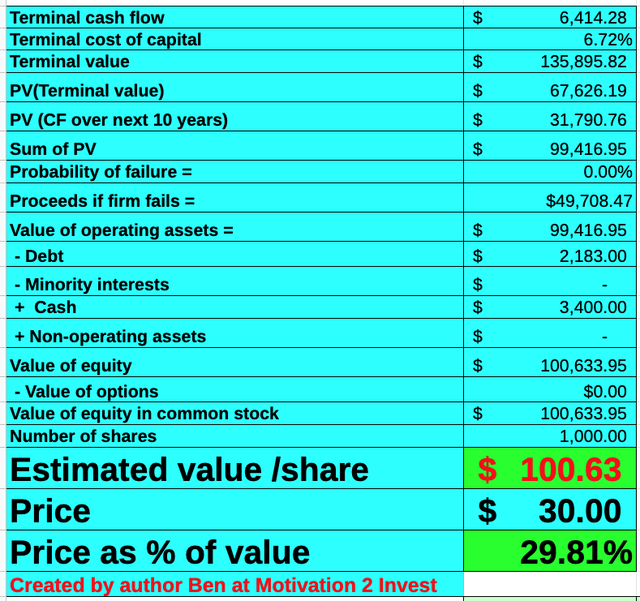

HPQ stock valuation 1 (created by Ben, Motivation 2 Invest).

These factors give me a fair price of $100 per share. HP stock trades at $30 per share as of the writing date. This is 70% less than its fair value.

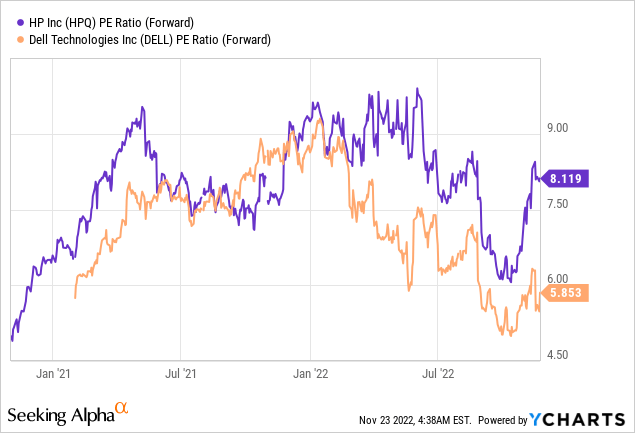

The forward Price to Earnings ratio of HP is 8.4, which is 10% lower than the 5 year average. Comparatively, HP trades at a lower valuation than Dell (DELL), which makes it an interesting datapoint.

Risques

Recession/Cyclical PC Supply

As we have mentioned, rising interest rates and high inflation have led many analysts to predict a recession. Companies in the personal computer sales business are experiencing a downturn, which makes it difficult to survive a recession. My personal belief is that HP’s small segment Print (3% of revenue) is in a declining sector. This is because I believe that physical paper is no longer necessary for the reasons mentioned before (e-signatures). We also have to consider the environmental impact of printing a lot of paper. 3D printing is a growing industry so HP could keep its crown.

Last Thoughts

HP Inc. is a legacy tech company and is currently facing several short-term headwinds, including the cyclical fall in computing and unfavorable FX currency rates. The HP management is very proactive and their bold cost-cutting plays should pay dividends in the long-term. This combination with the stock’s undervaluation makes HP Inc. an attractive long-term investment.